Jagmeet Singh says he's stepping down as the New Democratic Party leader after a rough election night that left the NDP without official party status — and him out of a seat.

In the early hours of Tuesday, Singh took the stage at the NDP's election party, holding back tears as he thanked his supporters, reflected on his time leading the party, and shared hopes for the future.

"Thank you. Thank you. Thank you and all of you in this room, you guys poured your heart into this. Thank you so much for everything you've done. You're amazing. Love you all," he said, kicking off an emotional speech.

It was a tough night across the board. As of Tuesday morning, according to CBC, the NDP was elected or leading in just seven ridings — a major collapse from the 24 seats they held before the campaign.

They also captured just 6.3% of the national vote, way down from the 17.8% they earned in 2021.

Singh didn't escape the fallout either. He lost his seat in Burnaby Central, a riding he'd held since 2019, finishing third.

Singh told the crowd, "It's been the honour of my life to represent the people of Burnaby Central. Tonight, they chose a new member of Parliament, and I wish them well as they continue to work hard for this community."

Despite the setback, Singh reminded the crowd that the fight wasn't over.

He congratulated Liberal leader Mark Carney on his projected win, adding, "He has an important job to do to represent all Canadians and to protect our country and its sovereignty from the threats of Donald Trump."

"Tonight and every night, all of us here, we're on Team Canada. We want Canada to thrive, and we're going to continue to fight for Canada," Singh added.

At times, it was clear Singh was struggling to keep his emotions in check. He spoke candidly about the sacrifices made by NDP candidates across the country who also came up short.

"I'm so sorry you're not gonna be able to represent your communities. I know you're going to continue to fight for them. I know how many doors you knocked, how many family dinners you missed, how many nights your kids went to bed without you there to tuck them in. I know it was a tough sacrifice [...]. Thank you," he said.

He urged New Democrats to stay hopeful even in defeat, saying, "Choosing to commit your life to politics obviously comes with some sacrifice, but we choose this life because of the chance to change the country you love for the better. We may lose sometimes, and those losses hurt."

"It's tough, but we are only defeated if we stop fighting. We're only defeated when we believe that those that tell us that we can never dream of a better Canada, a fairer Canada, a more compassionate Canada."

At one point, Singh joked that he couldn't make eye contact with supporters because the emotion was too overwhelming.

"So I just made the mistake of doing that," he laughed. "So I'm gonna look away now. You know who you are. Don't look at me again."

Reflecting on his journey, Singh reminded supporters how far they had come.

"Almost eight years ago, I was elected the leader of this incredible party, this incredible movement. I've worked really hard to be worthy of this trust, to live up to the legacy of our movement."

He confirmed he had informed the party leadership that he would step down once an interim leader could be named.

"Tonight, I've informed our party leader that I'll be stepping down as party leader as soon as an interim leader can be appointed."

Before wrapping up, Singh took a heartfelt moment to thank his family — and once again, the tears weren't far behind.

"I get emotional anytime I talk about my kids. I'm very sappy when it comes to my daughters. So, I get a little emotional," he said while giving a special shoutout to his wife, Gurkiran Kaur, and their two daughters, Anhad and Dani.

Pausing to gather himself, he added, "I might break down [during] this part, so forgive me. I can only do this, and we can only do this work, because of a great staff, and y'all just poured your heart into me into the work that we did."

Lightening the mood, Singh joked, "It's a good thing that there's water here! This water is very strategically placed for me, so it's very, it's very, very lucky that I have it!"

He closed his speech with optimism, saying he still believed in the NDP's mission.

"Obviously, I'm disappointed that we could not win more seats, but I'm not disappointed in our movement. I'm hopeful for our party. I know that we will always choose hope over fear, optimism over despair, and unity over hate."

"New Democrats literally built this country. We built the best of Canada, and we aren't going anywhere. Thank you, thank you so much. Love you all."

Singh wasn't the only party leader who had a rough night. While Mark Carney locked down a win in Nepean, Green Party co-leader Jonathan Pedneault placed fifth in Montreal. Conservative Leader Pierre Poilievre is also projected to lose his seat in Carleton.

Meanwhile, the Liberals managed to flip Burnaby Central — Singh's former riding — piling on another blow in an already difficult night for the NDP.

You can read more about the projected election results, Mark Carney's dramatic victory speech, and more, at MTL Blog's election hub.

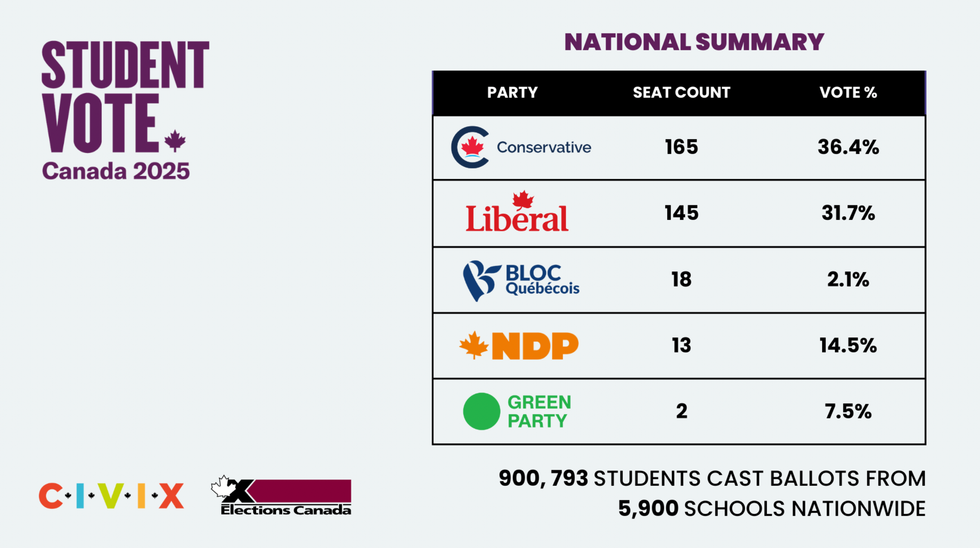

Students elect Conservative Party government in nationwide vote.

Students elect Conservative Party government in nationwide vote.