The childcare tax credit is changing in Quebec and parents could lose out

The maximum eligible age is dropping.

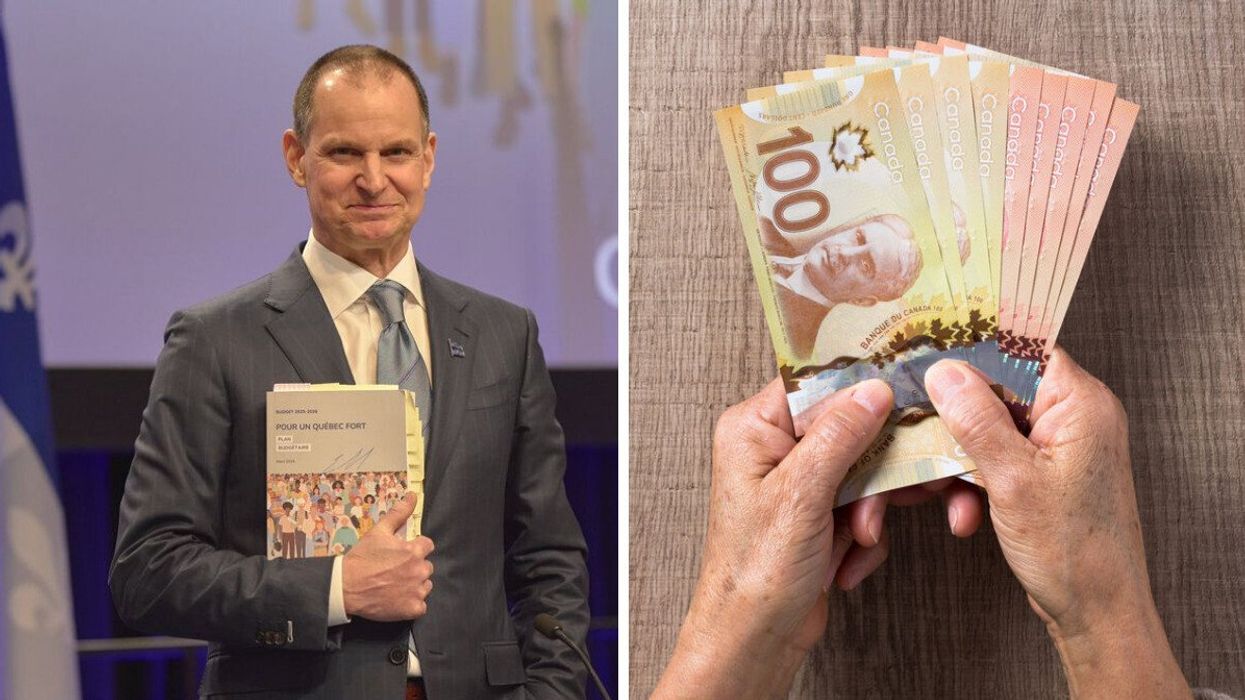

Quebec's new budget was announced on Tuesday.

The Quebec government's new budget for 2025-2026 is bringing some big changes that could hit many parents' wallets.

On March 25, Finance Minister Eric Girard announced the province's new budget, which includes a historic deficit of $13.6 billion — and some cutbacks to the childcare tax credit are part of the plan.

Starting in 2026, the maximum eligible age for the refundable childcare tax credit will drop from 16 years old to 14 years old, with some exceptions.

According to the budget, this change is meant to "adapt tax expenditures to new economic and social realities." The government claims this measure will save $55.1 million over five years. The goal, as stated in the budget, is to "refocus tax assistance on families with younger children."

So, what counts as eligible childcare expenses?

The childcare tax credit covers a range of childcare expenses, including fees paid to a daycare that doesn't offer reduced-contribution spaces and various types of childcare services in schools or home-based settings.

However, since teenagers no longer attend early childhood centres or daycare services, this change mainly affects parents paying for summer camps, boarding schools, or day camps — especially for children between the ages of 14 and 16. Those payments used to qualify for the tax credit, but the upcoming changes will reduce eligibility.

Here's a breakdown of what's covered:

- $200 per week for an eligible child aged six or under.

- $275 per week for an eligible child with a severe and prolonged mental or physical impairment (regardless of age).

- $125 per week for any other eligible child aged over six but under 16 (soon to be under 14).

Parents who rely on this tax credit to cover certain childcare expenses may want to take note and plan ahead.

The childcare tax credit cuts are part of Quebec's plan to tackle its $13.6 billion deficit, which makes up 2.2% of the province's GDP. The government's total spending for 2025-2026 is projected at $165.8 billion, including $156.1 billion for government operations and $9.7 billion for debt servicing.

AI tools may have been used to support the creation or distribution of this content; however, it has been carefully edited and fact-checked by a member of MTL Blog's Editorial team. For more information on our use of AI, please visit our Editorial Standards page.

- Canada's March 2025 Old Age Security payments are coming — Here's how much you can get ›

- Quebec residents can get payments from these 9 government benefits & credits in April ›

- No more tax credits for osteopathy and homeopathy in Quebec — Here's what's changing - MTL Blog ›

- Canada's most wanted criminal was just arrested on another continent - MTL Blog ›

- 8 government benefit payments you can get in May 2025 in Quebec - MTL Blog ›