Here's How Much You Need To Make To Afford A Mortgage In MTL Vs. Other Canadian Cities

In an effort to cool down the housing market, the federal government just made it harder for prospective homebuyers in Canada to get approved for a mortgage.

As of June 1, new mortgage stress test rules mean applicants need to prove they can afford a mortgage rate that's either 2% higher than their contract rate or 5.25% — whichever is higher — rather than the previous 4.79% threshold.

Editor's Choice: 6 Surprisingly Nice Montreal Apartments For Rent Right Now For $950/Month Or Less

This is shaking up the amount of income it takes to afford a mortgage across the country.

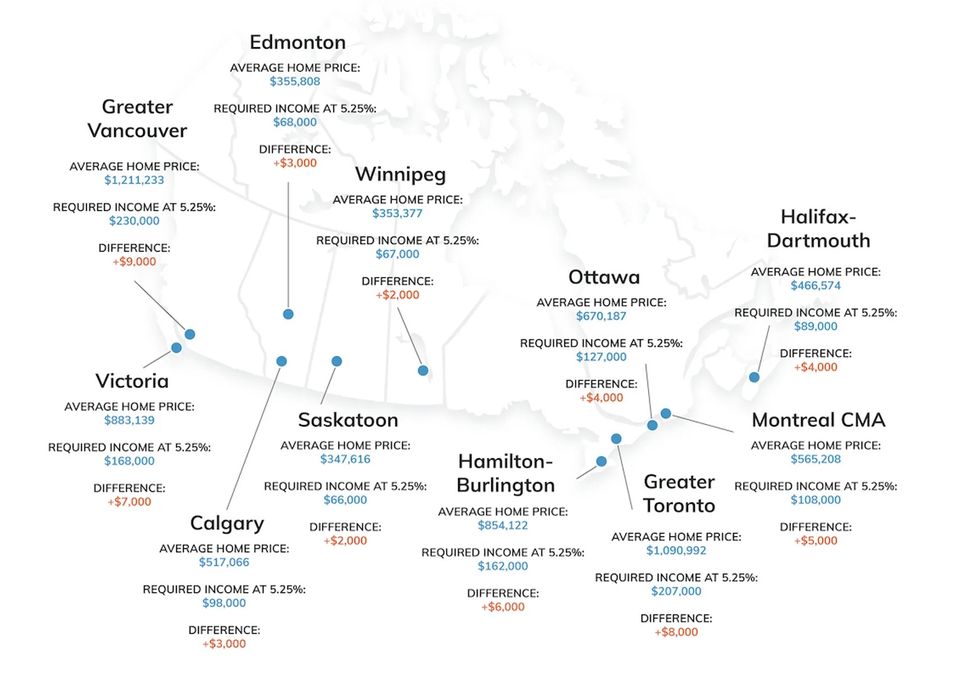

Real estate brokerage Zoocasa mapped out how this change impacts major Canadian cities, including Montreal, based on the average home price.

According to the map, you now need a salary of $108,000 to afford a mortgage in the Montreal Metropolitan Area where the average home price is $565,208 — an increase of $5,000 compared to prior stress test rules.