Montreal Rent Prices Are Up — Here’s How People Are Cutting Costs

Shared spaces, shared savings. 🏠

An "à louer" rental sign on a balcony in Montreal.

Montreal's once-affordable rental market is showing signs of change. While the city has long been known for its relatively reasonable living costs, recent reports show rent prices are still going up and a wave of anxiety is washing over Montreal tenants, changing how many live.

Rent hikes in Quebec

Recent data from the National Rent Report by Rentals.ca and Urbanation shows that out of 35 cities analyzed for average rent prices, Montreal took 21st in the country for rising rent costs.

A one-bedroom apartment is now priced at an average monthly rent of $1,784, while two-bedroom units go for $2,260. The year-on-year increase for these rates stands at 14.6% and 7.4%, respectively.

But Montreal isn't the only Quebec city facing added pressure. Both Laval and Quebec City have seen marked rent increases. Laval ranked 27th on the list with a monthly average of $1,590 for a single-bedroom and $2,004 for a two-bedroom apartment. That means an 18.8% jump for one-bedroom apartments and an 11.5% rise for two-bedroom spots.

Quebec City's 31st rank came with a monthly average of $1,216 for one-bedroom units and $1,650 for two-bedrooms. The past year showed a modest increase for one-bedroom apartments at 4.9% but a sharper rise of 15.2% for two-bedroom ones.

In a separate Zumper report on cities with the fastest growing one-bedroom rent, Québec City stood at 19th in the country for one-bedrooms climbing 24.8% since this time last year.

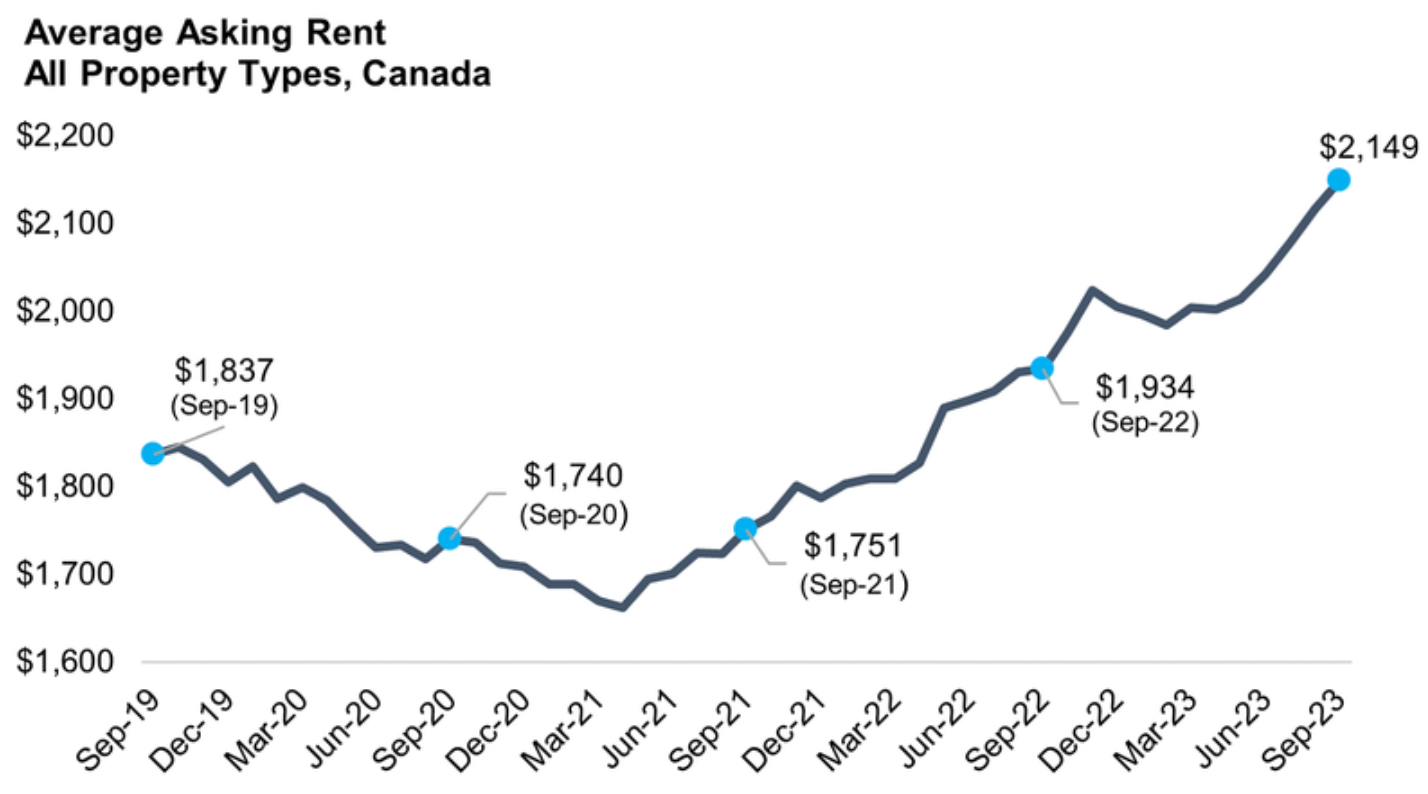

Rents nationwide are going up

Across Canada, the average rent experienced a hike of 1.5% in a single month, making the average rent now stand at $2,149. This year, there's been an overall rise of 11.1%.

One-bedroom apartments are facing the most significant rent price increases, with a sharp 15.5% rise this year. When it comes to provinces, Nova Scotia and Alberta are leading in terms of rent hikes.

Shaun Hildebrand of Urbanation shared some insight on the trend. He said that while rent prices are growing overall, some big cities may start to see a slower pace of growth. "Most major markets experienced a slower annual rate of rent growth [in September] compared to recent months,” he said. “This was particularly true in Toronto, where rents grew by their slowest pace in two years.”

Financial anxiety in Quebec

A report from Centraide of Greater Montreal, in partnership with Leger, shows that financial anxiety is pervasive among Quebecers, affecting 85% of the population since the spring. Those feeling severe anxiety are reportedly concerned about debt repayment, which ranks above housing and food costs. Certain demographics, including racialized individuals, parents, and young adults between 18 to 34, are feeling the strain most intensely.

Financial stressors, like rising costs of food, childcare, and unexpected expenses, weigh heavily on many. A sizable portion of parents (70%) dread the beginning of the school year due to associated costs. Meanwhile, 61% of young adults between 18 to 34 are worried they won't be able to afford a home. Other concerns include unforeseen expenses, potential job loss, and depleting retirement savings.

"More households, or 54%, are expecting an increase in housing costs in the coming months. This is an increase of 10 percentage points since April," said Christian Bourque, Executive Vice-President at Léger. "Quebeckers' financial uncertainty is not trending toward optimism either, as one in ten people considers themselves in a bad financial situation. It's like a grey cloud that just won't go away."

"Our social fabric is under great strain due to factors such as the housing crisis, increased food costs, and mental distress," said Claude Pinard, President and Executive Director of Centraide of Greater Montreal. "A significant number of people are experiencing financial anxiety because they are struggling to make ends meet."

Living with rising costs

The steep rise in housing costs, alongside other living expenses, is reshaping the way Canadians, especially in cities like Montreal, Laval, and Quebec City, approach their living situations. For generations, the trajectory for many was to graduate, secure employment, rent an apartment, and eventually transition to owning a home. However, surging costs are altering this progression, potentially for the foreseeable future.

Shared accommodations, traditionally a choice for students or those in their early adult years, are now becoming a necessity for more. It's a reflection of wider socio-economic shifts taking place in the country. Shared living is a practical solution to alleviate financial burden.

Listings for shared living spaces have seen a significant 27% increase in just the last three months, underscoring how individuals are actively seeking ways to manage the rising costs of living.

But Montreal residents have more to worry about than just the escalating rents. Bill 31 looms as a piece of proposed legislation that could destabilize a tenant's right to a lease transfer — often used to help secure lower rents by preventing landlords from imposing hikes during a change in tenancy. Bill 31 seeks to change that practice.

Teva Ross, representing Montreal's Autonomous Tenants' Union (SLAM), criticized the bill, calling it "unacceptable." If passed, the legislation could mean landlords collaborating with the provincial government against tenant interests, said Ross. SLAM organized a rent strike in August to protest.

"Without a strong response to Bill 31, we risk seeing more such policies that disadvantage tenants. We don't want to end up like Vancouver or Toronto, where affordability has become a major issue," said Ross.

The rising tide of rental costs in Montreal and other Quebec cities is altering the landscape of urban living in Canada. The data presents a clear challenge: maintain the affordability of city housing or risk becoming yet another metropolitan area where living costs outpace incomes. With potential legislative shifts like Bill 31 on the horizon, the stakes in Montreal are even higher. As the situation unfolds, the decisions made today will define the Montreal of tomorrow.

- English-Speaking Quebecers Are Twice As Likely To Live In Poverty, A New Study Finds ›

- A Quebec Bill Would Make It Illegal For Landlords To Ban Pets ›

- 6 Things Tenants Need To Know Before Renting A Montreal Apartment ›

- Montreal Rent Hit New Heights, But Signs Point To A Possible Slowdown - MTL Blog ›

- Canada's rent prices hit an all-time record high and Quebec is actually looking pretty good - MTL Blog ›

- Here's how much Montreal renters need to earn to afford a 3 1/2 in different neighbourhoods - MTL Blog ›

- Cirque du Soleil's Founder Is Selling His 50-Room Montreal Mansion — Here's A Look Inside - MTL Blog ›